How to measure and improve Customer Lifetime Value (CLV), Customer Retention Rate (CRR), & Customer Churn Rate (CCR)

This is the ultimate guide on how to measure and improve CLV, CRR and CCR. Here, you’ll find everything you need to know about the most important customer success metrics and what to do to achieve CX greatness.

Contents:

What is Customer Lifetime Value (CLV)

5 reasons why Customer Lifetime Value (CLV) is im#portant

How to measure Customer Lifetime Value (CLV) ‒ 5-step formula

How to improve Customer Lifetime Value (CLV) in 8 ways

What is Customer Retention Rate (CRR)

12 reasons why Customer Retention Rate (CRR) is important

How to measure Customer Retention Rate (CRR) ‒ 3 formulas

How to improve Customer Retention Rate (CRR)

What is Customer Churn Rate (CCR)

6 reasons why Customer Churn Rate (CCR) is important

How to measure Customer Churn Rate (CCR) ‒ 2 formulas

How to improve Customer Churn Rate (CCR) in 6 steps

Which metrics to use?

Conclusion

What is Customer Lifetime Value (CLV)

This article will teach you how to measure and improve CLV, CRR and CCR, but first – what is Customer Lifetime Value (CLV)? CLV is a metric that represents the total net profit a company is expected to have from a customer over the course of their entire relationship. In simpler terms, CLV is the average amount of money a customer is likely to spend on a company’s products or services during their lifetime.

So basically, the longer customers buy from a company, the bigger their lifetime value. The customers with a high CLV are the ones who make frequent, high-value purchases.

5 reasons why Customer Lifetime Value (CLV) is important

CLV is a key measure for determining a customer’s long-term worth. Calculating Customer Lifetime Value will indicate how much revenue they are likely to generate over their lifetime. You can then use this data to determine how much you should invest in customer acquisition and retention.

Still not convinced? Here are the top 5 reasons why to measure CLV:

- Knowing your customers’ CLV helps you discover which customer segments are the most valuable and spend your marketing and sales resources accordingly.

- If you know the CLV of different customer segments, you can make more informed decisions about budget allocation. For example, if you know that acquiring a new customer is more expensive than retaining an existing one, you may naturally choose to invest more in customer retention programs.

- Once you measure customers’ CLV acquired through different channels, you can make calculated decisions about which customer acquisition channels to focus on.

- CLV offers insight into a customer’s long-term value, which can drive strategic decisions about product development, expansion, and revenue projection.

- Knowing customer CLV means knowing who your most profitable customers are. With that information in your pocket, you can focus on retaining them and providing an exceptional customer experience.

How to measure Customer Lifetime Value (CLV) ‒ 5 step formula

So, at this point, you are wondering how to measure and improve CLV, CRR and CCR. According to research, just 42% of businesses can effectively measure their CLV. Follow this 5-step formula to successfully calculate CLV:

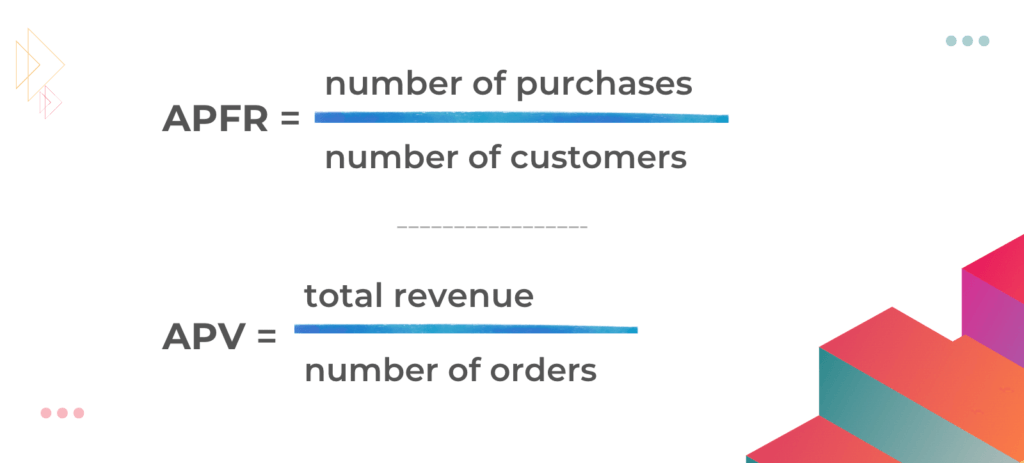

- First calculate the Average Purchase Frequency Rate (APFR) ‒ the number of times a customer makes a purchase over a specific period of time.

- Then calculate the Average Purchase Value (APV) ‒ the average amount of money spent by a customer during a single purchase.

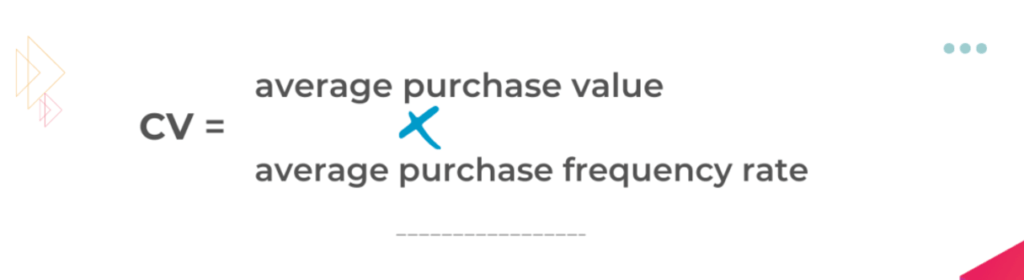

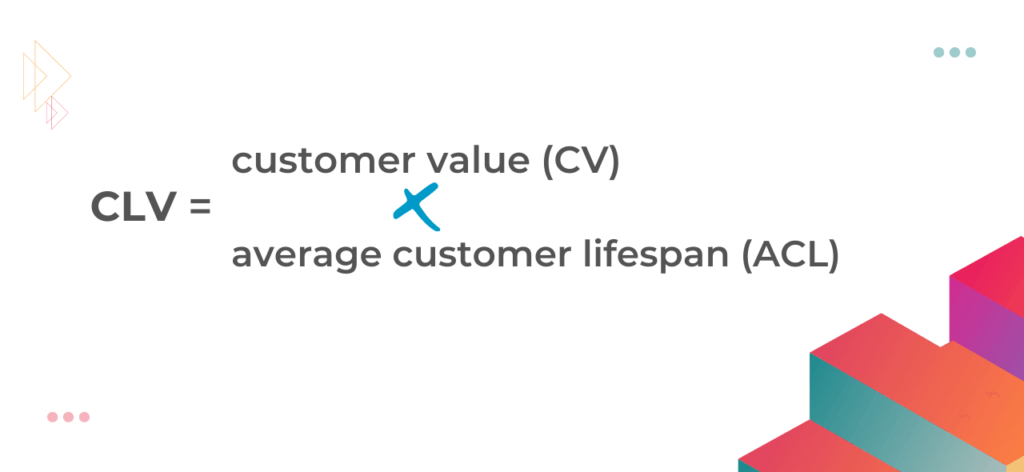

- Having the APFR and APV, you can now calculate the Customer Value (CV) ‒ the overall value that a customer brings to your business over a specific period of time.

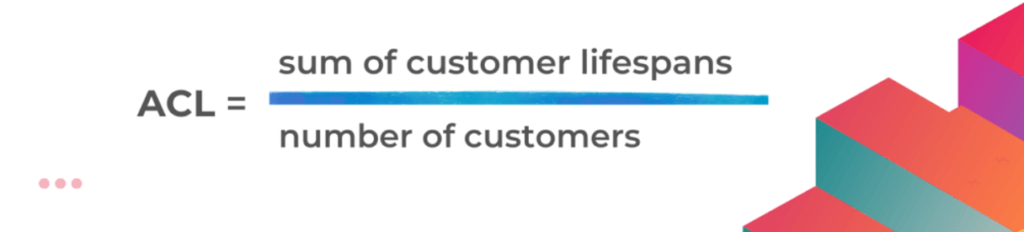

- Then calculate the Average Customer Lifespan (ACL) ‒ the average number of years a customer continues purchasing from your company.

- And finally, you can now calculate the Customer Lifetime Value (CLV).

How to improve Customer Lifetime Value (CLV) in 8 ways

1. Personalization, personalization, personalization

- Offer personalized incentives, such as discounts or rewards based on customer behavior or purchase history.

- Use customer data to make personalized product recommendations. 75% of consumers are more likely to buy following personalized recommendations.

- Personalize your marketing. More than 70% of consumers respond to marketing only when it’s customized to their interest, with around 75% of them being outright frustrated by generic adverts.

- Send emails with personalized subject lines. They are 50% more likely to be opened.

- Create customized landing pages for different customer segments or for specific campaigns.

- Personalize the communication by using the customer’s name, location, and other personal information.

- Use A/B testing to test different personalized messages and offers to see which ones perform best with different customer segments.

2. Active listening

63% of consumers expect businesses to recognize their individual needs and expectations.

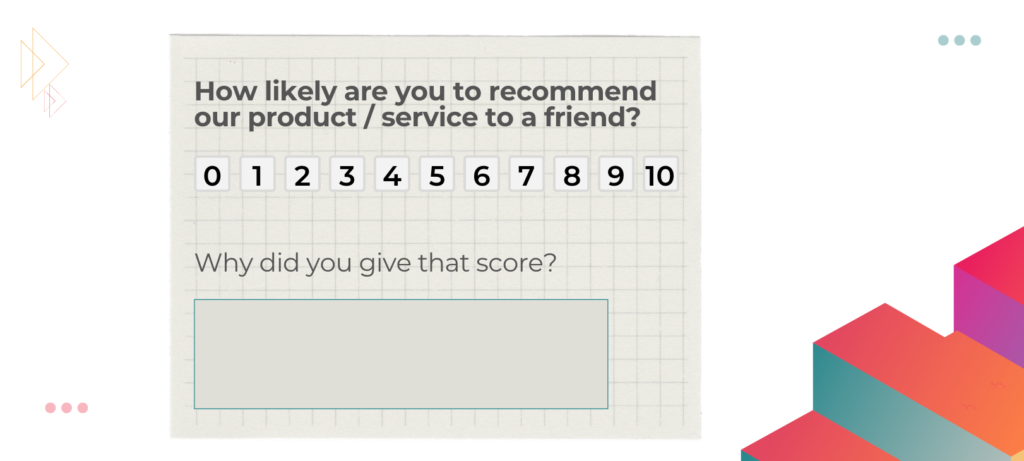

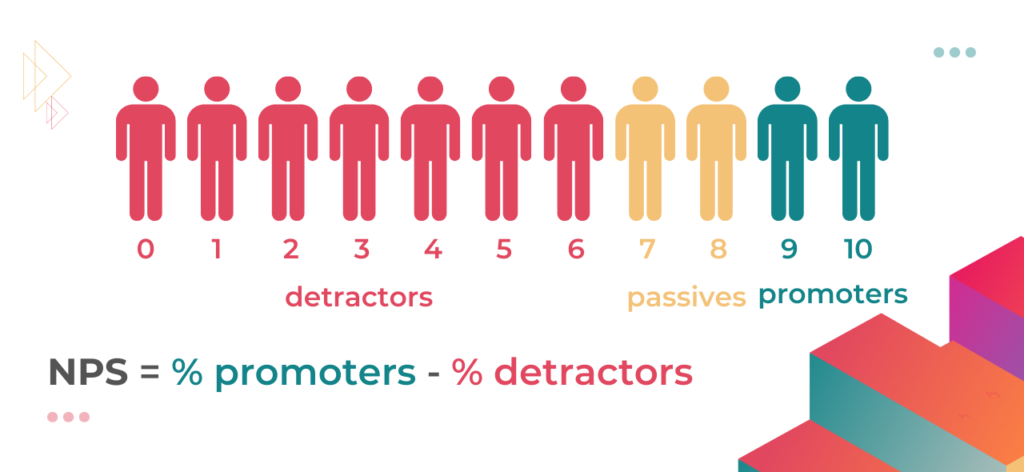

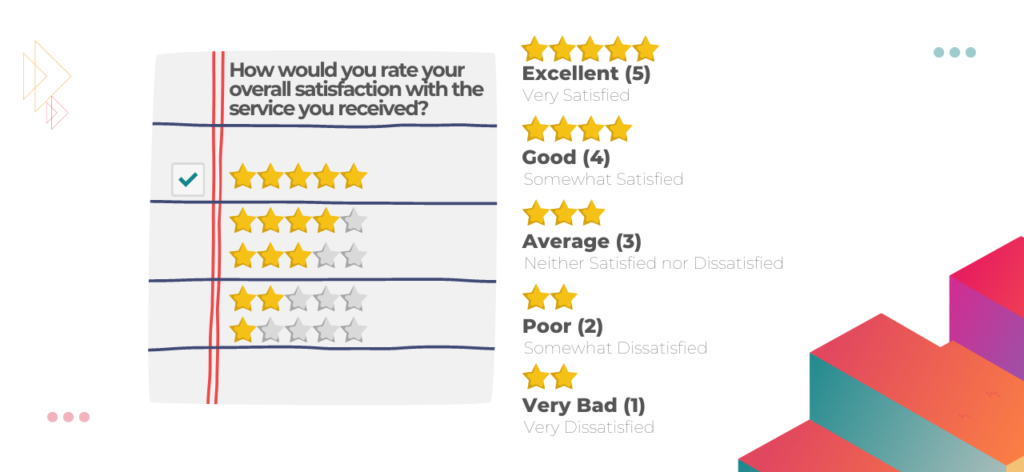

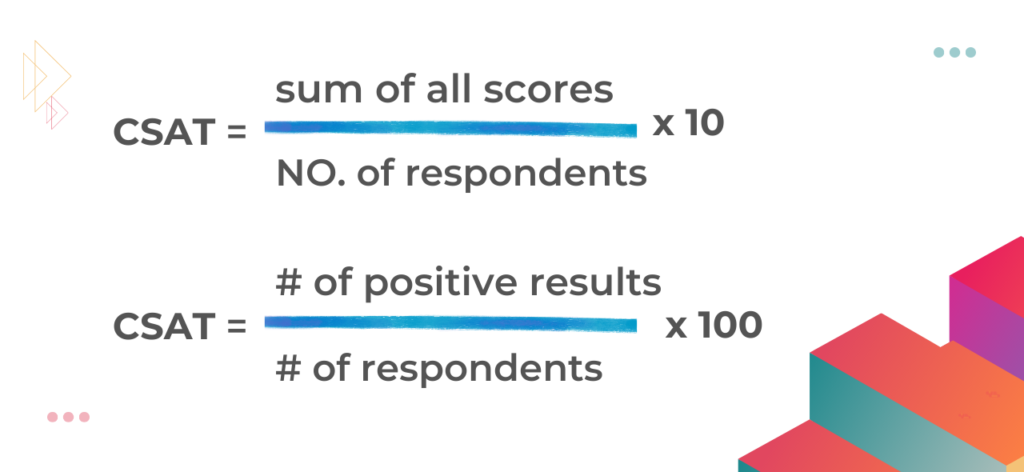

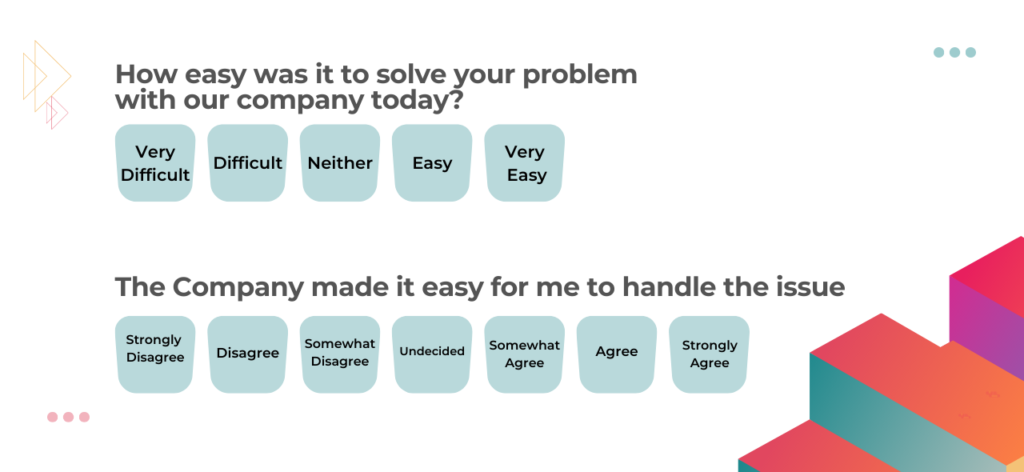

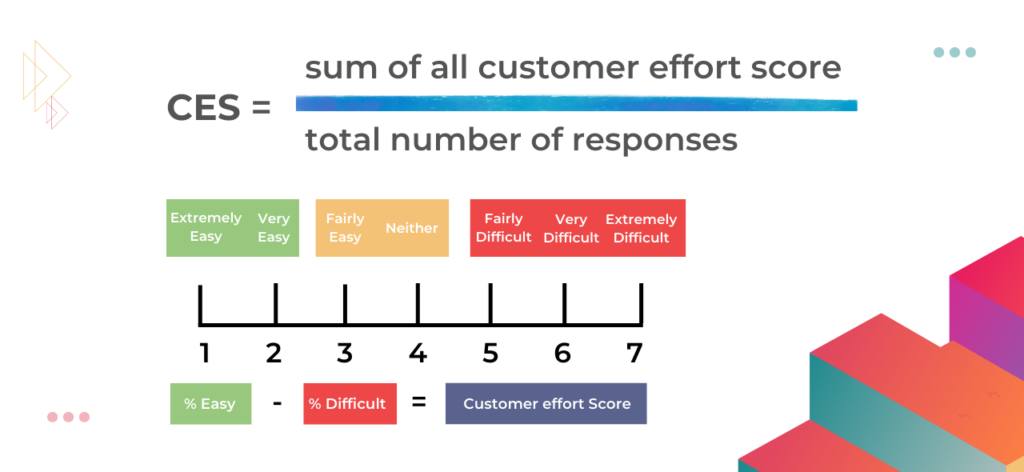

Evaluate your customer’s needs through surveys such as the NPS (Net Promoter Score), CSAT (Customer Satisfaction), and CES (Customer Effort Score). These will help you understand how customers perceive your brand and identify areas for development:

You may find information and formulas for measuring NPS, CSAT, and CES in the Measuring Customer Experience article.

| Make the most of your data by offering optional short comments on the rating. Allow consumers to explain their ratings and make suggestions on how to improve your customer service. Customers will appreciate the effort and remain loyal to your business if you ask for feedback and act on it. |

3. Monitor and analyze customer data

Use data and analytics to understand customer behavior, preferences, and spending patterns. This can help you identify opportunities for improvement and make more informed decisions about how to increase CLV.

4. Omnichannel personalization

From personalized marketing to personalized support, the omnichannel approach can greatly improve CLV. Delivering a consistent and seamless experience across all channels makes it easy for customers to receive the support they need, reducing customer effort and boosting their satisfaction.

Omnichannel integration will give your business a complete view of customer interactions and purchase history, helping you identify opportunities for personalized marketing, cross-selling and upselling.

Related: Next-Generation CX & Omnichannel Support

5. Reward loyalty

Your most loyal customers are your greatest brand advocates. Use customer data to create personalized offers or discounts that are tailored to their interests and purchasing habits.

Reward loyalty through discounts, freebies, or exclusive offers for frequent purchases. Give your loyal customers special access to events, sales, or early access to new products. Recognize their loyalty publicly on social media.

The key is understanding your customers’ value and creating a loyalty program that aligns with their needs and preferences.

6. Increase the frequency of communication

Regularly communicate with your customers about new products, services, and promotions. This will help to keep your business top of mind and increase the likelihood that customers will return.

7. Increase customer spending

Encourage customers to purchase more often and to purchase higher-priced items through upselling and cross-selling by offering incentives for larger purchases. Create product bundles and packages that make it easy for customers to purchase multiple products or services at once. For example, a customer buying a new laptop may also be encouraged to purchase a laptop bag, a warranty, and a mouse.

Always keep in mind the golden rule of upselling: customers should feel that the recommendations are tailored to them and not just a sales pitch.

8. Increase customer referral

Encourage happy clients to refer you to their friends and family. Referral schemes and incentives can help with this. Offering a referral program increases your CLV while also exposing you to new potential consumers, who can later be turned into loyal clients. Customers who have been referred have a 16% greater lifetime value and 18% lower turnover. In addition, 81% of consumers trust suggestions from people they know, and 55% discuss their new purchases on social media.

What is Customer Retention Rate (CRR)

The Customer Retention Rate (CRR) is a metric that calculates the percentage of customers who continue to do business with a company over time.

Customer retention refers to the process of keeping customers. It can be used to uncover trends and patterns in consumer behavior and is used to track how successfully a company retains its customers.

12 reasons why Customer Retention Rate (CRR) is important

Calculating CRR will help you understand how many customers continue doing business with you. Read on to find out why client retention is crucial for the success of your business:

- Acquiring new customers involves marketing and advertising costs, which is why it is 5 to 25 times more expensive than keeping existing ones.

- The likelihood of selling to an existing customer is 60-70%, as opposed to 5-20% to a new customer.

- Existing customers spend 31% more.

- Existing customers are 50% more inclined to try new products.

- Even a 5% improvement in client retention improves profitability by 25-95%.

- Existing customers contribute to word-of-mouth marketing.

- Existing customers are five times more likely to purchase and four times more likely to refer than new visitors.

- Long-standing relationships make for easier data-gathering about customer behavior. This helps development, marketing, and sales efforts.

- CRR helps identify issues, suggestions, and opportunities to increase customer loyalty and retention.

- CRR provides insights into how many users value your product over time.

- Enables targeting ideal customers.

- New customers come and go, but an established customer base can provide a more stable source of revenue.

| Despite this, 44% of businesses prioritize client acquisition versus 18% that favor retention. |

How to measure Customer Retention Rate (CRR) ‒ 3 formulas

CRR formula #1

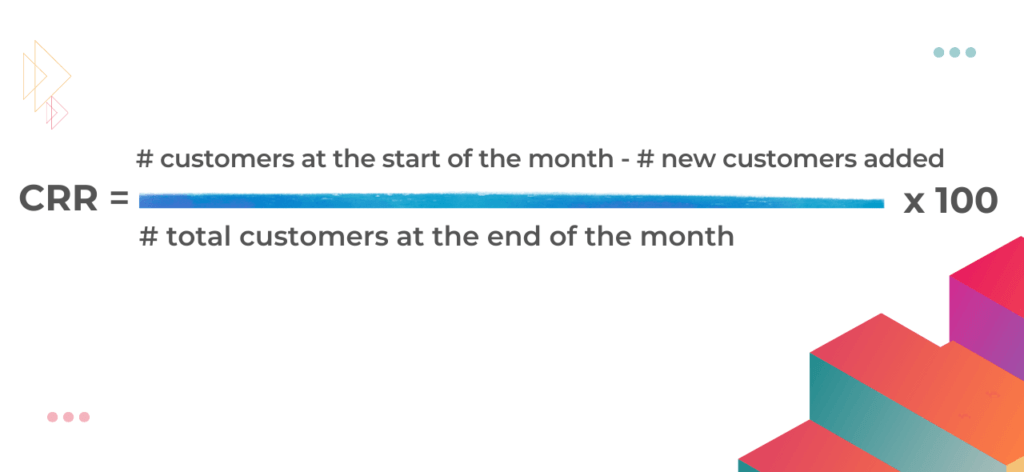

Add the total number of customers at the end of the month, subtract the number of new customers added during the month, and divide by the total number of customers at the start.

It looks like this:

CRR formula #2

Subtract the number of customers who churn over time from those who remain loyal:

90% retention – 10% churn = 80% retention rate

CRR formula #3

Consider how many customers remain loyal for one period of time versus another.

% of loyal customers in period one / % of loyal customers in period two = retention rate

How to improve Customer Retention Rate (CRR)

Customer Retention Rate and Customer Lifetime Value are strongly linked. In other words, they are both a result of a successful and profitable relationship with your customers.

The higher the CLV, the higher the CRR is likely to be. If you take the initiative to raise your Customers’ Lifetime Value, retention will most likely follow suit. This is not pure cause-and-effect, but the two values are both driven by the exact origin: customer satisfaction.

As a result, to increase the CRR, follow the above 8 steps for improving Customer Lifetime Value.

What is Customer Churn Rate (CCR)

Customer Churn Rate, or Customer Attrition Rate, is the percentage of customers that stop doing business with your company.

In a subscription model, it is the percentage of subscribers who cancel their subscriptions within a given time period.

6 reasons why Customer Churn Rate (CCR) is important

A high percentage of customer churn is a red flag for businesses as it suggests that they are losing clients at an alarming rate, and there must be a reason behind it.

Regularly measuring your CCR rate will allow you to react to negative trends and prevent other customers from leaving.

- 32% of customers would stop doing business with a brand or company they’d previously loved after just one negative experience.

- Getting new customers ‒ or winning over churned ones ‒ is far more expensive than keeping existing ones. In particular, between 4 and 10 times more.

- The lower the churn rate, the larger the number of loyal customers.

- CCR measures the impact of various products/services/projects or company initiatives.

- CCR determines the company’s progress and provides benchmarks to measure against.

- Some industries are more affected by churn than others: in the United States, online retail has a churn rate of about 22%. However, SaaS companies aim for a yearly 5% or less churn rate.

How to measure Customer Churn Rate (CCR) ‒ 2 formulas

CCR formula #1

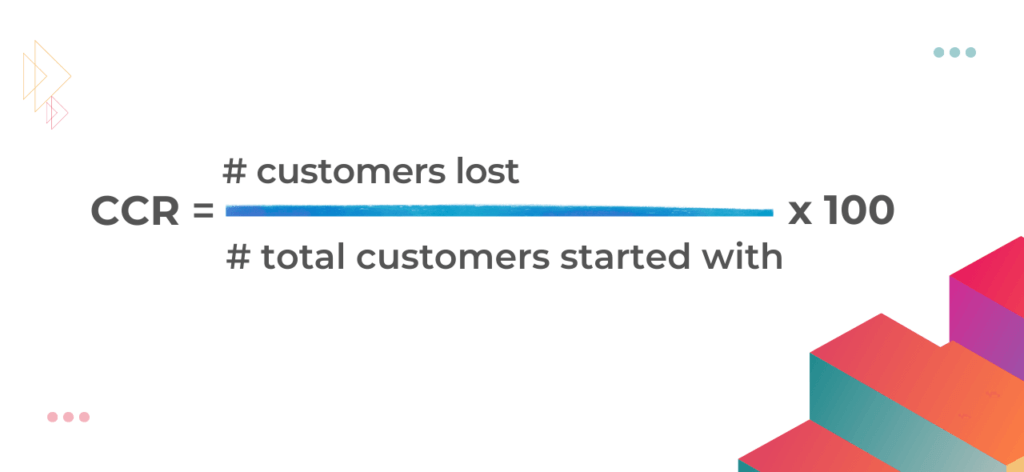

- First define a specific period to calculate your churn rate.

- Then divide the number of customers who churned by the total number of customers you had at the start of the time period.

- The formula is: CCR = total number of customers lost divided by total customers started with.

CCR formula #2

Another possible way to calculate the churn rate is to do a reverse sum of the retention rate.

Churn Rate = % lost customers in period X / % lost customers in period Y

How to improve Customer Churn Rate (CCR) in 6 steps

Aside from following the eight steps to boost CLV and CRR ‒ which will also positively influence the CCR rate ‒ there are other measures to take to avoid a high customer churn rate (CCR):

1. Identify customers at risk of churning

Use data analytics to identify customers at risk of churning and reach out to them ahead of time to address any difficulties or concerns they may have.

2. Investigate why customers are leaving

Determine why customers are leaving through surveys, calls, focus groups, or other feedback channels. Then take steps to solve the core problems.

3. Provide incentives

Offer incentives for staying, such as loyalty programs, exclusive deals, or other perks.

4. Work on improvement

Continuously work on improving the quality and features of your product or service. The needs of your customers are constantly evolving, and so should you.

5. Be proactive

Monitor customer engagement and be ready to address any concerns that may arise. Be proactive in finding and solving potential issues.

6. Invest in retention marketing

Use targeted marketing efforts to retain existing customers, and make sure they are aware of the value they are receiving from your company.

[Read more] How to measure Customer Experience

Which metrics to use?

There are many metrics for measuring the customer experience, but should you track all of them? Well, the answer is no. BUT, you should carefully review your business goals, set the indicators relevant to your business, and measure those. Before you send out surveys and ask for customer feedback, you should know precisely how to measure and improve CLV CRR and CCR.

However, we think it’s important to understand the appropriate customer experience metrics for your company’s growth. Moreover, it’s important to know how to measure and improve CLV, CRR and CCR. But, if you have difficulty identifying, tracking, and measuring all those metrics, you can always reach out to us. FrontLogix provides strategies for improving your overall customer experience and improving the CLV, CRR, CCR, and other important KPIs.

STRATEGY GUIDE

6 Simple Strategies To Improve Customer Retention

Actionable insights and proven techniques to keep your customers coming back.

Conclusion

Providing a positive customer experience is critical to keeping your customers happy and satisfied. They’ll stay longer, and you’ll have better business results. As a result, investing time and money in measuring customer experience metrics is essential. These metrics will not only help you understand how simple your customers find it to use your product or service, but they will also provide you with actionable insights into improving many aspects of your business. This can significantly impact your company by lowering churn or increasing retention.

Simultaneously, these metrics can help you see where your CX team excels and where they can improve. Collecting and analyzing these metrics can also improve your products, services, and procedures. The better you understand how your customers use your offer, the more enjoyable you can make the entire CX for them. Finally, we hope this article helped you learn how to measure and improve CLV, CRR and CCR and you’ll finally reach the success you long for!